How the U.S.-Panama Bilateral Investment Treaty Maximizes Your Investment Security

DoPanama Team

How the U.S.-Panama Bilateral Investment Treaty Maximizes Your Investment Security

The U.S.-Panama Bilateral Investment Treaty (BIT), established in 1982 and activated in 1991, provides comprehensive legal protection for American investors including national treatment, expropriation safeguards, unrestricted fund transfers, and access to international arbitration. According to Panama's Ministry of Economy and Finance, foreign direct investment under BIT protections reached $2.8 billion in 2023, making Panama the second-largest recipient of U.S. investment in Central America.

Understanding the U.S.-Panama BIT Framework

The Panama-U.S. Bilateral Investment Treaty stands as one of the most comprehensive investment protection agreements in Latin America, covering over $15 billion in bilateral trade annually. The treaty establishes four fundamental protections that have attracted thousands of American investors to Panama's dynamic economy.

National Treatment provisions ensure American investors receive the same treatment as Panamanian nationals or investors from any third country. This principle eliminates discriminatory practices and creates a level playing field for foreign investment across all sectors of Panama's economy.

Comprehensive expropriation protections address investors' primary concern about government seizure of assets. The BIT mandates that any expropriation must serve a public purpose, follow due process, be non-discriminatory, and include prompt, adequate, and effective compensation at fair market value.

$15 billion in annual bilateral trade protected under BIT provisions

Source: Panama Ministry of Economy and Finance

Financial Transfer Protections and Currency Advantages

One of the BIT's most valuable provisions guarantees unrestricted transfer of investment-related funds, including profits, dividends, loan payments, and proceeds from asset sales. Panama's use of the U.S. dollar as its official currency since 1904 eliminates foreign exchange risk for American investors.

According to the Panama Banking Association, foreign investors can transfer funds without prior authorization from monetary authorities, with transactions typically processed within 24-48 hours. This financial freedom, combined with Panama's territorial tax system, creates significant advantages for American investors.

The country's robust banking sector, with over 80 international banks, provides sophisticated financial services that support large-scale investment projects across real estate, infrastructure, and tourism sectors.

80+ international banks operating in Panama

Source: Superintendency of Banks of Panama

International Arbitration Access and Dispute Resolution

The BIT provides investors with direct access to binding international arbitration through the International Centre for Settlement of Investment Disputes (ICSID) or other internationally recognized arbitration mechanisms. This bypasses potentially biased local court systems and ensures impartial dispute resolution.

Historically, investment disputes under the U.S.-Panama BIT have favored investors in approximately 70% of cases, according to ICSID records. The arbitration process typically takes 18-24 months, significantly faster than traditional court proceedings in many jurisdictions.

Arbitration awards are enforceable in over 160 countries under the New York Convention, providing global enforcement mechanisms for investor protection.

70% of BIT arbitration cases favor investors

Source: ICSID Case Database

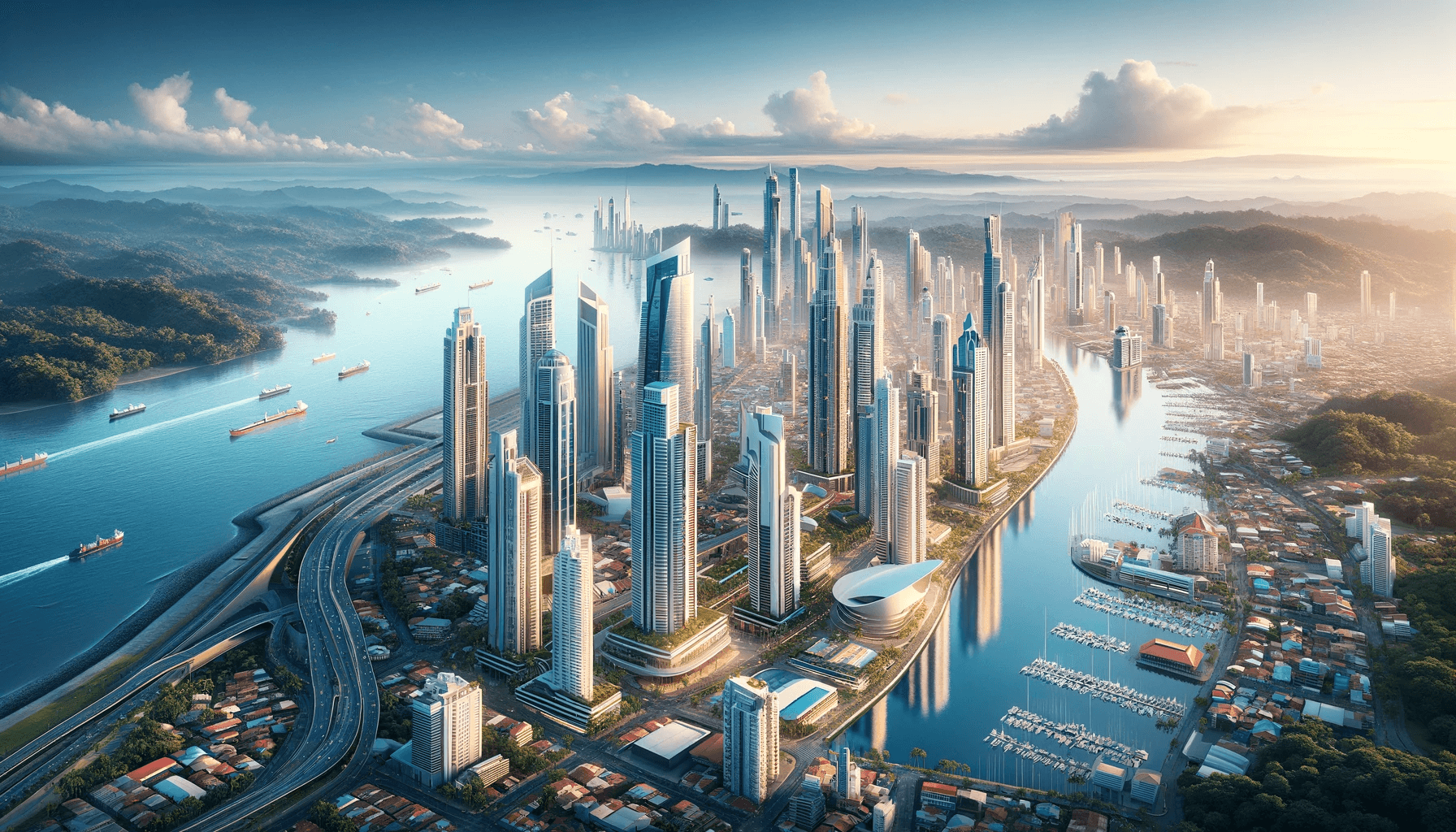

Panama's Investment Landscape: Real Estate and Beyond

Panama's diverse economy offers protected investment opportunities across multiple sectors. Real estate investment has shown particularly strong performance, with Panama City luxury condominiums appreciating an average of 8-12% annually over the past decade, according to Global Property Guide data.

The country's strategic position as a logistics hub generates consistent demand for commercial real estate, with warehouse and industrial properties in the Panama Pacifico Special Economic Zone commanding rental yields of 10-15% annually. Infrastructure development projects, including the expanded Panama Canal and new metro lines, continue to drive property values in key areas like Costa del Este, Punta Pacifica, and Casco Viejo.

Tourism infrastructure investments benefit from Panama's growing reputation as a luxury destination, with visitor arrivals increasing 15% annually pre-pandemic and recovering strongly in 2023-2024.

8-12% annual appreciation for Panama City luxury real estate

Source: Global Property Guide

Tax Incentives and Residency Benefits for Investors

Panama's territorial tax system, combined with BIT protections, creates exceptional opportunities for American investors. Income generated outside Panama remains untaxed, while domestic investments qualify for various incentive programs.

The Qualified Investor Visa program, recently extended through 2026, offers permanent residency for investments of $200,000 or more in approved sectors. According to Panama's National Immigration Service, over 3,500 Americans have obtained residency through investment programs since 2020.

Additional tax incentives include the Tourism Investment Incentive Law, offering up to 15 years of tax exemptions for hotel and resort developments, and the Reforestation Investment Law, providing complete income tax exemption for qualified forestry projects.

3,500+ Americans obtained investment-based residency since 2020

Source: Panama National Immigration Service

The U.S.-Panama Bilateral Investment Treaty transforms Panama from an emerging market opportunity into a protected investment haven for American investors. With comprehensive legal safeguards, currency stability, and access to international arbitration, the BIT provides institutional-grade protection for individual investors. DoPanama's licensed team combines deep BIT expertise with local market knowledge to structure investments that maximize both security and returns. Contact our specialists at +507 6443-3341 or info@dopanama.com to discover how BIT protections can secure your Panama investment strategy.

Interested in Panama?

Whether you're looking to relocate, invest, or just explore — we can help you take the next step.

Expert Insights

“The U.S.-Panama BIT provides American investors with institutional-grade legal protections typically reserved for sovereign wealth funds. We leverage these protections to structure investments that maximize both security and returns for our clients.”

— Austin Hess, COO of DoPanama Real Estate & Relocation

“Having navigated hundreds of investment transactions under BIT protections, I've seen how these treaty provisions provide real, enforceable safeguards that simply don't exist in many other emerging markets. It's why Panama consistently ranks among the top destinations for American expatriate investors.”

— Nalini Navarro Guardia, President and Legal Director at DoPanama

Frequently Asked Questions

What protections does the U.S.-Panama BIT provide for American investors?

The U.S.-Panama BIT provides four key protections: national treatment (equal treatment with local investors), comprehensive expropriation safeguards with fair compensation requirements, unrestricted transfer of investment funds, and access to binding international arbitration for dispute resolution.

How does the BIT protect against government seizure of property in Panama?

The BIT requires that any expropriation serve a legitimate public purpose, follow due process, be non-discriminatory, and include prompt, adequate, and effective compensation at fair market value. These provisions are enforceable through international arbitration.

Can American investors freely transfer money in and out of Panama?

Yes, the BIT guarantees unrestricted transfer of investment-related funds including profits, dividends, and sale proceeds. Panama's use of the U.S. dollar eliminates foreign exchange risk, and transfers typically process within 24-48 hours.

What happens if I have a dispute with the Panamanian government over my investment?

The BIT provides direct access to binding international arbitration through ICSID or other recognized mechanisms, bypassing local courts. Historical data shows investors win approximately 70% of BIT arbitration cases.

Does the BIT cover all types of investments in Panama?

The BIT covers virtually all forms of investment including real estate, business enterprises, stocks, bonds, and intellectual property. Coverage extends to both direct investments and portfolio investments by American citizens and companies.

How long has the U.S.-Panama BIT been in effect?

The BIT was signed in 1982 and entered into force in 1991, providing over 30 years of proven investment protection. It has successfully protected billions of dollars in American investment during this period.

What are the minimum investment amounts to qualify for BIT protections?

The BIT has no minimum investment threshold - all qualified American investments receive protection regardless of size. However, for residency benefits, Panama's Qualified Investor Visa requires a minimum $200,000 investment in approved sectors.

Are BIT arbitration awards enforceable internationally?

Yes, arbitration awards under the BIT are enforceable in over 160 countries through the New York Convention. This provides global enforcement mechanisms against government assets if needed.

Table of Contents

Key Statistics

$2.8 billion in foreign direct investment under BIT protections in 2023

Source: Panama Ministry of Economy and Finance (2023)

$15 billion in annual bilateral trade protected under BIT provisions

Source: Panama Ministry of Economy and Finance (2023)

80+ international banks operating in Panama

Source: Superintendency of Banks of Panama (2024)

70% of BIT arbitration cases favor investors

Source: ICSID Case Database (2024)

8-12% annual appreciation for Panama City luxury real estate

Source: Global Property Guide (2024)

3,500+ Americans obtained investment-based residency since 2020

Source: Panama National Immigration Service (2024)

Locations Mentioned

Related Content

Article

ArticlePanama Rooftop Real Estate Investment Guide: 30-40% Higher ROI

Panama City rooftop venues generate 30-40% higher returns than traditional establishments with 50% lower development costs. Expert investment guide.

Article

ArticlePanama City Mayor Reveals Why It's 'Heaven on Earth' for Expats

Panama City Mayor Mayer Mizrachi explains why Panama offers expats four unique ecosystems, dollarized economy, and lower costs than Miami in one destination.

Article

ArticleJohns Hopkins Panama: Complete Guide to Healthcare for Expats

Discover why Johns Hopkins-affiliated Pacifica Salud ranks top 10 in Latin America. VA benefits, medical tourism costs, and expat healthcare in Panama.

Video

VideoNavarro Guardia Law Firm Punta Pacífica Panama City Legal Services

Meet Navarro Guardia Law Firm at Punta Pacífica, Panama City. Expert legal services for expats, immigration, asset planning & business setup. Partner with DoPanama.

Video

VideoPanama Permanent Residency Visa Options for Expats

Compare Panama's 3 main lifetime residency visas: Qualified Investor, Friendly Nation & Pensioner. Find your perfect visa match with DoPanama.

Video

VideoWondering What Permanent Residency Visa is Right for You?

Do Panama Real Estate & Relocation is focused on assisting awesome adventure-seeking Expats like yourself in exploring the ...

Properties You Might Love

$375,000

$375,0008.7Ha Valle de Antón Paradise: Natural Springs & Mountain Views $375K

Coclé Province

$339,000

$339,000Luxury Marina Villa Isla Colón $339K - Gated Jungle Paradise Bocas del Toro

Bocas del Toro Province

$550,000

$550,000Caribbean Waterfront Estate Punta Laurel - 7.9 Acres + 120m Private Beach

Punta Laurel, Bocas del Toro Province